Unlocking Effectiveness and Pace with ACH Transfers: An extensive Check out OnlineCheckWriter.com

Within the at any time-evolving landscape of monetary transactions, technology has played a pivotal role in reworking how we transfer funds. One these types of advancement is Automated Clearing Home (ACH) transfers, a electronic conduit connecting banking institutions for seamless Digital transactions. OnlineCheckWriter.com, an sector leader, harnesses the strength of ACH transfers to offer end users by using a streamlined, Value-efficient, and efficient payment Option.

Comprehension ACH Transfers

At its Main, ACH transfers are Digital transactions conducted in between banking institutions by way of an automatic clearing network. This expansive procedure accommodates a spectrum of financial pursuits, like fund transfers, personal payments, Invoice settlements, employer deposits, and federal government Positive aspects. Consumers leverage the Automated Clearing House Network to seamlessly mail dollars to organizations, marking a departure from standard payment strategies.

Signing Up without cost and Seamless Transactions

OnlineCheckWriter.com provides forth a consumer-pleasant platform which allows individuals and enterprises to join absolutely free. The platform facilitates equally paying out and receiving resources via many channels, like wire transfers, Check out drafts, and check by mail companies, all in a small transaction charge. This affordability and flexibility make OnlineCheckWriter.com a most popular choice for People trying to find an extensive payment Resolution.

The Position of NACHA in ACH Payments

At the center of ACH payments may be the Countrywide Automatic Clearing House Affiliation (NACHA), a guiding pressure inside the seamless execution of digital bank-to-lender transactions. NACHA oversees and manages ACH expert services, providing a standardized framework for credit transfers and direct debits. The ACH process is inherently created for batch payments, often imposing expenses on enterprises or vendors that acquire financial institution transfers. It's noteworthy that OnlineCheckWriter.com proudly holds the excellence of staying an Formal NACHA member, ensuring a motivation to marketplace requirements and greatest tactics.

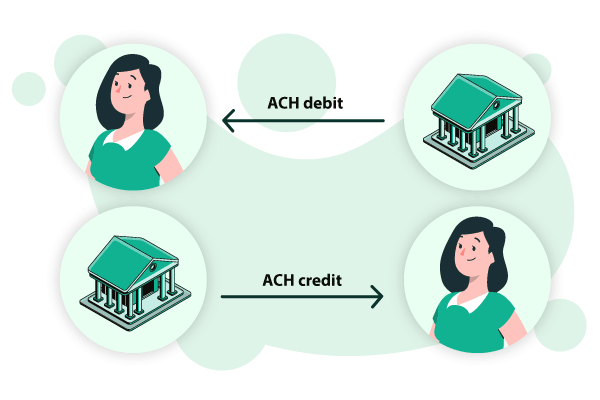

Diving into ACH Debits and Credits

Two Major varieties of ACH transactions are debits and credits. ACH debits require retailers withdrawing cash straight from shoppers' accounts with good authorization. Customers grant permission for your transaction by offering their routing variety and account facts, making a seamless and automated approach for bill payments together with other monetary transactions.

To the flip side, ACH credits entail depositing revenue right into a receiver's account. As an example, when an employer sets up immediate deposits, staff members furnish their title, bank account quantity, and transaction amount of money. This details empowers companies to transfer resources for their employees' accounts regularly. The duality of ACH transactions, encompassing the two debits and credits, provides a layer of flexibility to the overall financial ecosystem.

Same Working day ACH: Revolutionizing Money Transactions

A notable evolution in the ACH landscape is the appearance of Same Day ACH transactions. This characteristic has revolutionized finance by providing firms and people today a swift, simple, and successful payment option. In contrast to regular banking procedures that entail waiting around intervals, Very same Day ACH transactions permit genuine-time payments. OnlineCheckWriter.com has embraced this innovation, seamlessly integrating Similar Working day ACH into its platform.

The introduction of Identical Working day ACH by OnlineCheckWriter.com has profound implications for firms, slicing fees, streamlining transactions, and optimizing cash flow administration. The velocity and simplicity of Exact same Day ACH, coupled with the safety and affordability it offers, posture it for a powerful alternate to traditional banking practices. Corporations can now conduct fiscal transactions with unprecedented speed and efficiency, contributing to a far more agile and responsive economic ecosystem.

Conclusion: Transforming Transactions with OnlineCheckWriter.com

In summary, The mixing of ACH transfers in the financial landscape has actually been a activity-changer, redefining how we carry out transactions. OnlineCheckWriter.com emerges ach being a frontrunner in harnessing the prospective of ACH transfers, providing customers a platform that combines affordability, performance, and stability.

By remaining a Element of the NACHA community, OnlineCheckWriter.com demonstrates a commitment to adhering to business standards, guaranteeing people benefit from a protected and reputable System. The inclusion of Exact Working day ACH even further cements its posture as an innovator, supplying enterprises and people that has a Device that not only retains pace with modern monetary needs but also sets new benchmarks for speed and effectiveness.

Because the money ach landscape continues to evolve, OnlineCheckWriter.com stands for the forefront, empowering customers to navigate the digital realm of ACH transfers with self-assurance and relieve. In the globe wherever time is of the essence, OnlineCheckWriter.com makes sure that economic transactions are not just performed competently but also seamlessly, contributing to some long run exactly where the motion of cash is as swift as the clicking of a button.

Contact Us:

[email protected]

(408) 775-7720

111 N Market St, San Jose, CA 95113

250 Monroe Ave. NW, Suite 400 Grand Rapids, Michigan

Po Box 6543, Tyler TX 75711