Unlocking Performance and Speed with ACH Transfers: A Comprehensive Examine OnlineCheckWriter.com

During the at any time-evolving landscape of economic transactions, technologies has performed a pivotal job in transforming just how we transfer resources. A person these kinds of progression is Automated Clearing Household (ACH) transfers, a digital conduit connecting financial institutions for seamless electronic transactions. OnlineCheckWriter.com, an sector leader, harnesses the power of ACH transfers to provide consumers having a streamlined, Price-productive, and productive payment Remedy.

Comprehension ACH Transfers

At its Main, ACH transfers are electronic transactions done amongst banks through an automatic clearing network. This expansive process accommodates a spectrum of economic activities, such as fund transfers, particular person payments, Invoice settlements, employer deposits, and government Advantages. Customers leverage the Automated Clearing House Community to seamlessly deliver revenue to corporations, marking a departure from common payment methods.

Signing Up for Free and Seamless Transactions

OnlineCheckWriter.com delivers forth a consumer-friendly System that enables individuals and corporations to join absolutely free. The System facilitates the two having to pay and getting cash by way of a variety of channels, such as wire transfers, Test drafts, and Examine by mail products and services, all in a negligible transaction cost. This affordability and versatility make OnlineCheckWriter.com a favored option for All those trying to get a comprehensive payment Answer.

The Position of NACHA in ACH Payments

At the guts of ACH payments is the Countrywide Automatic Clearing Property Association (NACHA), a guiding drive during the seamless execution of electronic lender-to-financial institution transactions. NACHA oversees and manages ACH expert services, supplying a standardized framework for credit score transfers and direct debits. The ACH process is inherently made for batch payments, frequently imposing charges on corporations or distributors that obtain bank transfers. It can be noteworthy that OnlineCheckWriter.com proudly holds the distinction of remaining an Formal NACHA member, guaranteeing a commitment to marketplace expectations and ideal techniques.

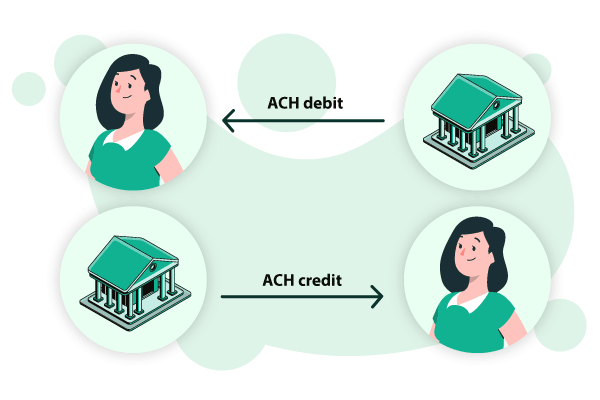

Diving into ACH Debits and Credits

Two Key sorts of ACH transactions are debits and credits. ACH debits require retailers withdrawing resources directly from prospects' accounts with suitable authorization. Customers grant authorization for that transaction by offering their routing range and account data, making a seamless and automated method for bill payments as well as other fiscal transactions.

On the flip facet, ACH credits entail depositing revenue right into a receiver's account. As an illustration, when an employer sets up direct ach deposits, employees furnish their name, banking account variety, and transaction quantity. This facts empowers companies to transfer money for their workers' accounts frequently. The duality of ACH transactions, encompassing both equally debits and credits, provides a layer of versatility to the overall money ecosystem.

Same Working day ACH: Revolutionizing Fiscal Transactions

A noteworthy evolution in the ACH landscape is the arrival of Same Working day ACH transactions. This attribute has revolutionized finance by offering corporations and folks a quick, straightforward, and productive payment possibility. Not like conventional banking procedures that require ready intervals, Exact same Working day ACH transactions enable actual-time payments. OnlineCheckWriter.com has embraced this innovation, seamlessly integrating Identical Day ACH into its platform.

The introduction of Same Day ACH by OnlineCheckWriter.com has profound implications for enterprises, cutting expenses, streamlining transactions, and optimizing income flow administration. The speed and simplicity of Same Day ACH, coupled with the security and affordability it provides, place it as being a compelling option to regular banking techniques. Firms can now perform fiscal transactions with unprecedented speed and efficiency, contributing to a far more agile and responsive money ecosystem.

Conclusion: Transforming Transactions with OnlineCheckWriter.com

In summary, The combination of ACH transfers into your economical landscape has actually been a sport-changer, redefining how we carry out transactions. OnlineCheckWriter.com emerges being a frontrunner in harnessing the likely of ACH transfers, featuring people a System that combines affordability, efficiency, and security.

By currently being a Portion of the NACHA network, OnlineCheckWriter.com demonstrates a motivation to adhering to sector standards, guaranteeing end users reap the benefits of a protected and trustworthy System. The inclusion of Very same Working day ACH additional cements its placement as an innovator, giving companies and persons which has a Instrument that don't just keeps pace with present day money demands but will also sets new requirements for velocity and effectiveness.

Because the fiscal landscape carries on to ach evolve, OnlineCheckWriter.com stands within the forefront, empowering consumers to navigate the electronic realm of ACH transfers with confidence and relieve. In the world where time is with the essence, OnlineCheckWriter.com ensures that financial transactions are not only performed competently but in addition seamlessly, contributing to the foreseeable future wherever the motion of cash is as swift as the press of the button.

Contact Us:

[email protected]

(408) 775-7720

111 N Market St, San Jose, CA 95113

250 Monroe Ave. NW, Suite 400 Grand Rapids, Michigan

Po Box 6543, Tyler TX 75711